In the ever-evolving real estate landscape, homeowners often grapple with the question: should they build a new home or renovate their existing one? While personal preferences, sentimental attachments, and specific needs play a role, current interest rates, especially for new home builds and construction loans, can be a determining factor.

Interest rates for new home builds and construction loans have historically fluctuated based on broader economic conditions. In periods of economic growth, rates may rise to control inflation. Conversely, during downturns, rates may fall to stimulate borrowing.

The Economics of Building New vs. Renovating

Cost of Borrowing: When interest rates are low, the cost of borrowing for a new home or construction loan decreases. This can make the prospect of building a new home financially attractive. Conversely, if you’re considering tapping into your home equity to finance a renovation, lower interest rates can reduce the cost of home equity loans or lines of credit.

Return on Investment (ROI): Some renovations offer significant ROI, such as kitchen and bathroom updates. However, if the cost of renovation approaches or exceeds the value it adds to your home, building a new home might be the better choice.

Long-term Value: Building a new home allows homeowners to incorporate modern designs, energy efficiencies, and technologies, which can lead to long-term savings. On the other hand, certain renovations can add immediate value to your home, especially if they address structural issues or modernize outdated systems.

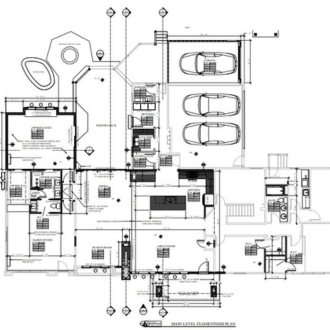

Personalization and Needs: A new build offers customization, ensuring the space meets your current and future needs. In contrast, renovations might be limited by the existing structure or layout.

Disruption vs. Fresh Start: Renovations can be disruptive, requiring you to live amidst construction or temporarily relocate. Building a new home avoids this, but involves its own set of challenges, like securing temporary housing until the new property is ready.

In the Long Run: What Gives More Value?

The decision to build a new home or renovate isn’t solely a financial one. However, from a purely economic perspective, the value proposition often hinges on current market conditions, the scale of the renovation, and long-term housing goals.

In markets where housing prices are skyrocketing, building a new home can offer a higher long-term ROI, especially when borrowing costs are low. Conversely, in stable or declining markets, strategic renovations can boost the value of an existing home, yielding a better return when selling.

The choice between building new and renovating is multifaceted. While current interest rates are a significant consideration, homeowners should also weigh personal preferences, immediate needs, and long-term goals. Whether you’re envisioning a brand-new dream home or reimagining your current space, the journey should be in line with both your financial strategy and your vision for the future. Always consult with financial and real estate professionals to get a comprehensive picture tailored to your situation.

Interested in building a new home or renovating your existing home – we can help with that!

Contact us today!